Nonprofits that receive federal grant funding must comply with Uniform Guidance (2 CFR 200) to maintain funding, ensure transparency, and avoid penalties. These federal regulations, established by the Office of Management and Budget (OMB), set the standard for financial management, procurement, allowable costs, and audits.

Understanding these rules is essential for nonprofit leaders, grant managers, and finance teams to ensure proper fund allocation, accountability, and reporting. In this guide, we break down 2 CFR 200 and how nonprofits can implement best practices for grant compliance.

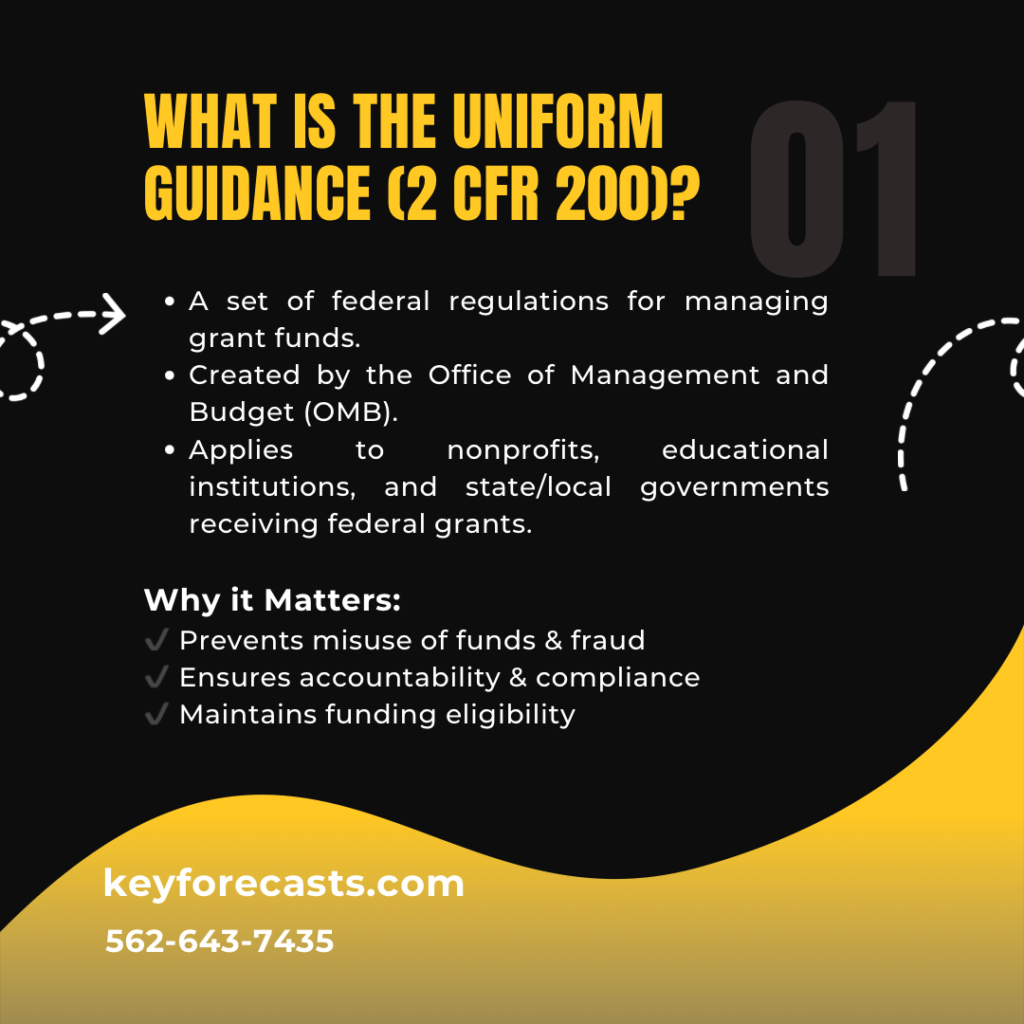

What is Uniform Guidance (2 CFR 200)?

Uniform Guidance (2 CFR 200) consolidates federal grant regulations into one standardized framework, ensuring that nonprofits and other recipients follow consistent financial practices when managing federal funds. These regulations cover financial management, procurement, cost principles, and audit requirements.

Complying with these regulations ensures that nonprofits use grant money appropriately, avoid mismanagement, and remain eligible for future federal funding. Failure to adhere to 2 CFR 200 can result in financial penalties, loss of funding, and federal audits.

Key Areas of 2 CFR 200 Compliance

1. Financial Management & Internal Controls

Nonprofits must establish strong internal controls to prevent fraud, waste, and financial mismanagement. This includes maintaining detailed financial records, ensuring funds are used only for approved grant purposes, and following Generally Accepted Accounting Principles (GAAP).

2. Procurement Standards & Competitive Bidding

Nonprofits using federal funds for procurement must follow competitive bidding and fair vendor selection processes. Open and fair competition in purchasing decisions, conflict of interest policies to prevent favoritism, and documentation of procurement transactions for transparency are key elements.

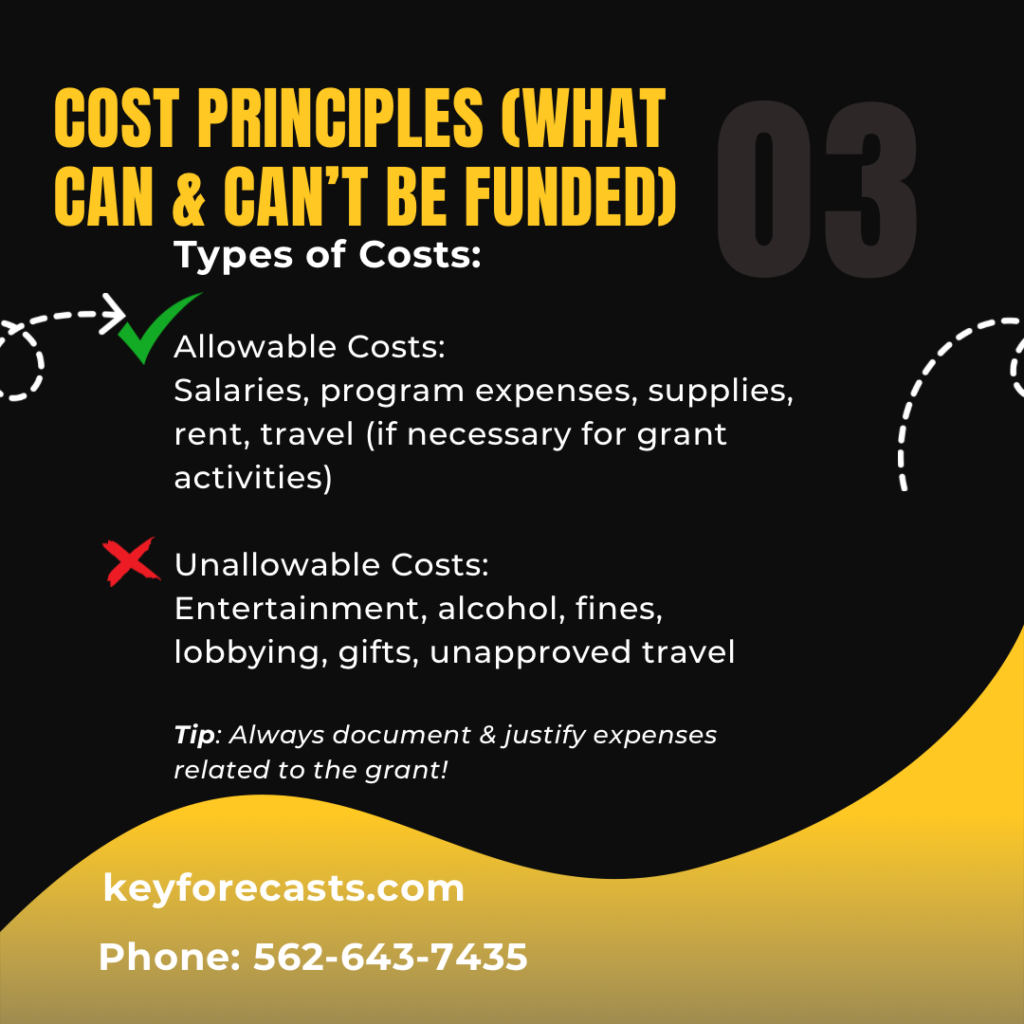

3. Allowable vs. Unallowable Costs

Understanding what expenses are permitted under 2 CFR 200 is critical. Allowable costs include salaries, rent, supplies, and program expenses, whereas unallowable costs include entertainment, alcohol, lobbying, and fines.

Proper cost allocation ensures that federal grant money is spent responsibly and in compliance with regulations.

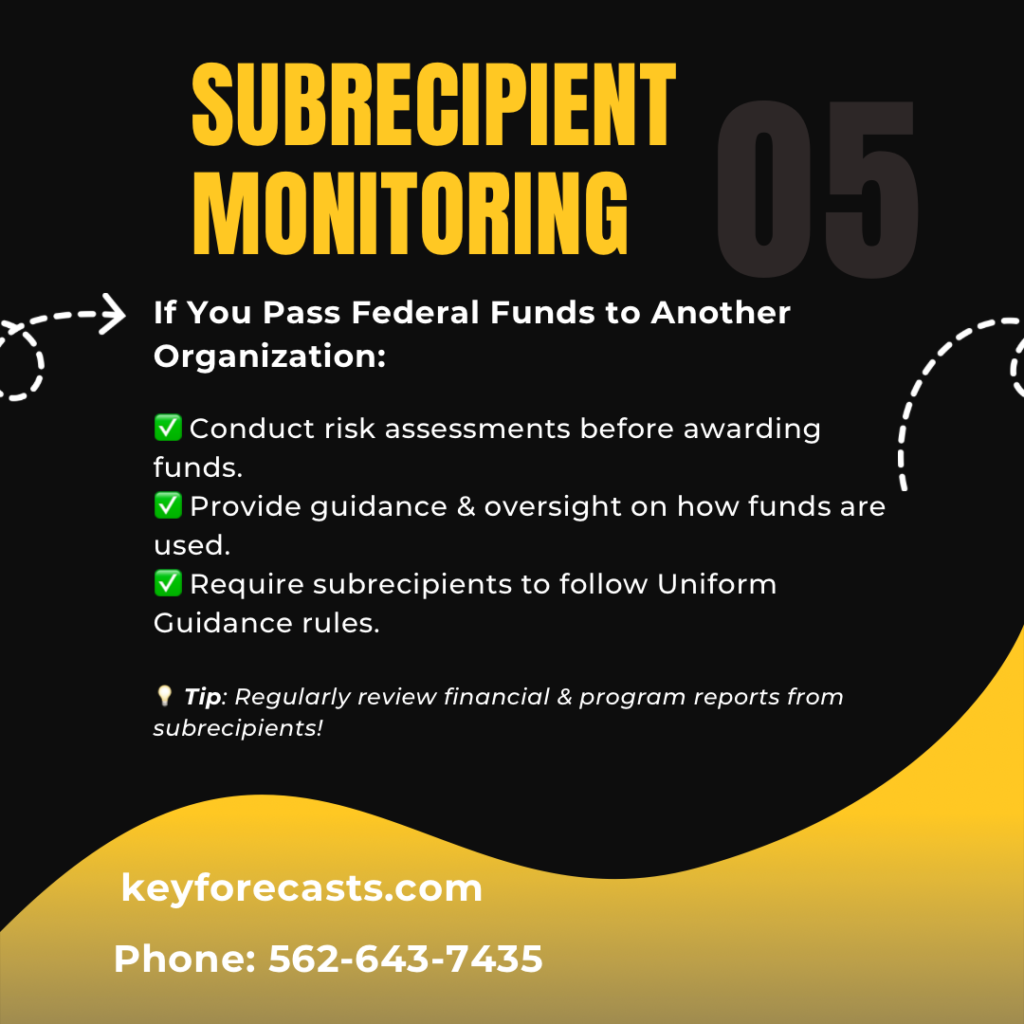

4. Subrecipient Monitoring & Oversight

If a nonprofit passes grant funds to other organizations (subrecipients), it must conduct risk assessments before awarding funds, provide guidance and oversight to ensure compliance, and require financial reporting and program accountability from subrecipients.

5. Single Audit Requirements

If a nonprofit spends $750,000 or more in federal grant funds annually, it must undergo a Single Audit. This audit is performed by an independent auditor, evaluates financial statements and internal controls, and is submitted to the Federal Audit Clearinghouse (FAC).

Why Compliance with 2 CFR 200 Matters

Failure to follow Uniform Guidance (2 CFR 200) can result in loss of federal funding, increased audit risks, and financial penalties.

Implementing strong internal controls, accurate financial tracking, and compliance policies ensures that nonprofits maintain grant eligibility and financial transparency.

Best Practices for Grant Compliance

Develop written financial policies to manage federal grants effectively, train staff and leadership on Uniform Guidance requirements, use grant accounting software to track spending and reporting, and conduct internal compliance checks before official audits.

Ensuring compliance with 2 CFR 200 not only protects a nonprofit’s funding but also strengthens trust with donors, stakeholders, and grantmakers.

Final Thoughts

Understanding and implementing Uniform Guidance (2 CFR 200) is essential for nonprofit financial sustainability. By following federal grant compliance best practices, organizations can avoid penalties, secure future funding, and demonstrate financial transparency.

For expert support in grant management, compliance, and financial tracking, contact Key Forecasts: Phone: 562-643-7435 Email: info@keyforecasts.com Website: keyforecasts.com

770 S Grand Ave

Los Angeles, CA 90017

562-643-7435

info@keyforecasts.com