Step-by-Step: Understanding the Key Differences Between Bookkeeping and Accounting

The Financial Compass: Navigating Bookkeeping and Accounting in Los Angeles

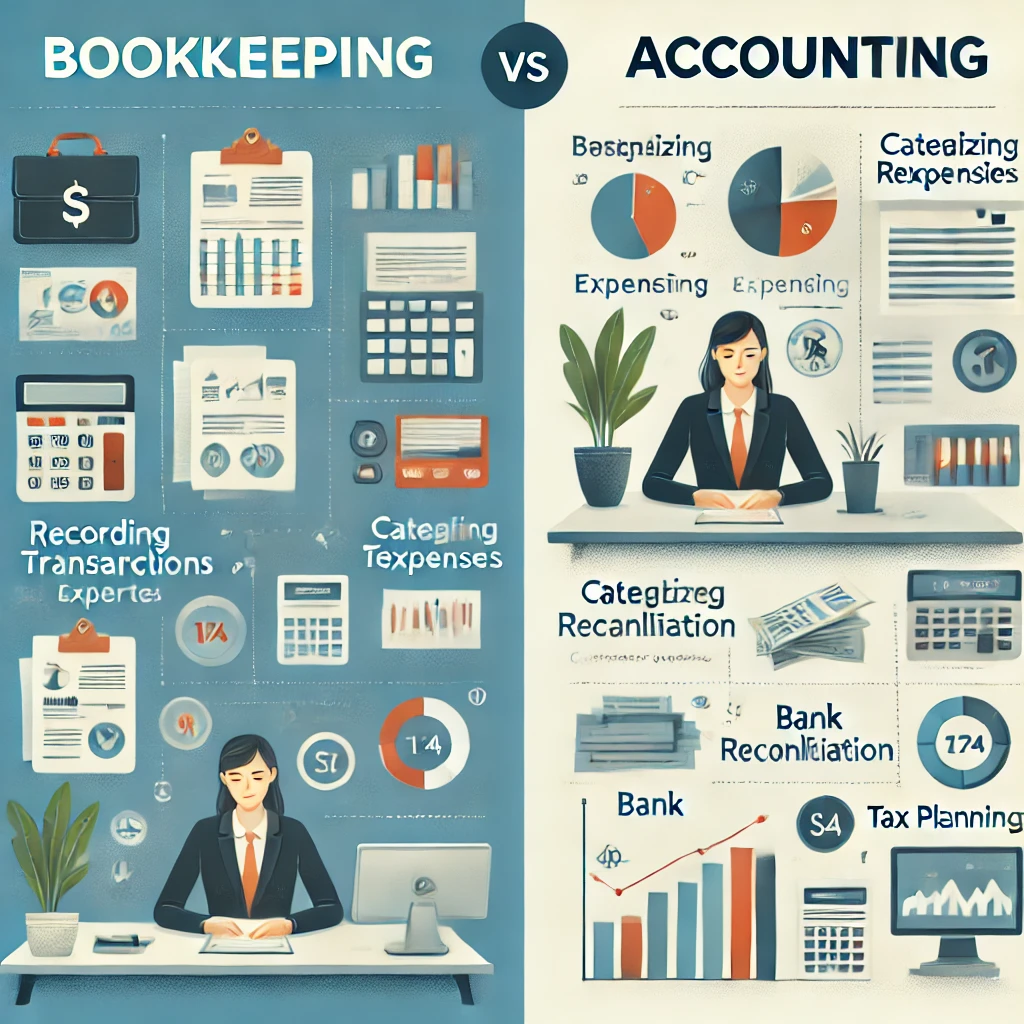

Bookkeeping vs. Accounting: Key Differences Every LA Small Business Owner Needs to Know

As a small business owner in Los Angeles, understanding the difference between bookkeeping and accounting can save you time, reduce stress, and ultimately lead to better financial decision-making. Though often used interchangeably, these two terms represent distinct roles in managing your business’s finances. Let’s dive into the key differences between bookkeeping and accounting and how each plays an important role in ensuring your business’s financial health.

What is Bookkeeping?

Bookkeeping is the process of recording and organizing all of a business’s financial transactions. For small business owners in Los Angeles, this means tracking every sale, purchase, payment, and receipt. A bookkeeper is responsible for maintaining accurate records of all financial activity, ensuring that each transaction is categorized correctly in the general ledger.

Key bookkeeping tasks include:

- Recording sales and expenses

- Categorizing transactions

- Reconciling bank statements

- Managing payroll

Why Bookkeeping Matters for Small Businesses in LA

Having a reliable bookkeeping system is essential for small business owners in Los Angeles. It allows you to have a clear picture of your daily financial activities, which can directly impact decisions about budgeting, spending, and planning for growth. For example, understanding your monthly cash flow can help you avoid costly mistakes and prepare for seasonal fluctuations in your revenue.

What is Accounting?

Accounting, on the other hand, is a broader concept that involves interpreting, analyzing, and summarizing the financial data recorded by the bookkeeper. Accountants use this data to create comprehensive financial reports, make recommendations, and ensure that businesses comply with tax laws and regulations.

Key accounting tasks include:

- Preparing financial statements (balance sheet, profit and loss statement)

- Analyzing financial data for trends and forecasting

- Tax planning and filing

- Offering strategic financial advice

Why Accounting is Crucial for Small Businesses in LA

As an LA small business owner, having an accountant can provide invaluable insights into your business’s financial future. An accountant will help you interpret the data collected through bookkeeping to make informed business decisions, reduce tax liabilities, and ensure compliance with the state’s strict financial regulations.

Key Differences Between Bookkeeping and Accounting

| Aspect | Bookkeeping | Accounting |

|---|---|---|

| Primary Focus | Recording day-to-day transactions | Analyzing and interpreting financial data |

| Key Responsibilities | Organizing financial transactions | Creating financial reports, tax planning |

| Frequency | Ongoing, daily or weekly updates | Periodic (quarterly, annually) |

| Skill Set | Attention to detail, organization | Analytical thinking, financial forecasting |

| Outcome | Accurate financial records | Strategic financial advice, tax compliance |

When Do Small Businesses Need Bookkeeping vs. Accounting Services?

Many small businesses in Los Angeles benefit from outsourcing both bookkeeping and accounting, but understanding when each service is needed is essential for making smart financial decisions.

- Bookkeeping is required regularly to maintain accurate and organized financial records.

- Accounting becomes necessary for interpreting this data, preparing taxes, and offering strategic business advice.

By outsourcing your bookkeeping to professionals, you can ensure that your financial records are always up-to-date and organized, which in turn provides your accountant with the data needed to provide sound advice.

Why LA Small Businesses Need Both Bookkeeping and Accounting

Both bookkeeping and accounting services for small businesses in LA play vital roles in business success. While bookkeeping ensures your financial data is accurately recorded, accounting helps you use that data to make informed, strategic decisions that promote long-term growth.

Having reliable bookkeeping and accounting services is especially important for small businesses operating in Los Angeles, where competition is fierce, and financial regulations are complex. With virtual accounting services available, small business owners in LA can easily access expert advice without the need for in-house staff.

How Key Forecasts Can Help

At Key Forecasts, we specialize in providing comprehensive bookkeeping and accounting services tailored to small businesses in the Los Angeles area. Whether you need help organizing your finances or interpreting your financial data for long-term planning, our team is ready to help. Our expertise in both bookkeeping vs. accounting allows us to provide integrated services that keep your business running smoothly and financially secure.

If you’re ready to take control of your finances, contact us today to schedule a free consultation. We can help you navigate the complexities of bookkeeping and accounting and set your business on the path to success.