How to Start a Nonprofit in Los Angeles: A Step-by-Step Guide

Step-by-step guide for starting a nonprofit in Los Angeles, including information about fiscal sponsorship, costs, and various nonprofit options.

Starting a nonprofit in Los Angeles is a rewarding venture, whether you aim to serve the community, support a cause, or provide services. But the process can seem complex without the right information. This comprehensive guide breaks down everything you need to know, from selecting the nonprofit type to registering with the state and applying for tax-exempt status. Plus, we’ll cover the option of fiscal sponsorship for nonprofits that want to get started quickly without forming their own 501(c)(3) right away.

Step 1: Define Your Mission and Purpose

The first step in starting any nonprofit is clearly defining your mission and goals. This is crucial because your mission will guide your nonprofit’s activities, funding, and even your legal structure. Nonprofits in Los Angeles can fall under various categories, including but not limited to:

- 501(c)(3) Charitable Organizations – The most common type of nonprofit, focused on charitable, religious, educational, or scientific purposes.

- 501(c)(4) Social Welfare Organizations – These engage in lobbying or political activities in addition to social welfare purposes.

- 501(c)(6) Business Leagues – Such as trade associations or chambers of commerce.

Understanding the type of nonprofit you want to form will impact the next steps, including registration and obtaining tax-exempt status.

Step 2: Choose a Name for Your Nonprofit

Your nonprofit’s name should be unique and reflective of your mission. It must not be too similar to another registered entity in California. You can check for name availability via the California Secretary of State’s business search tool.

Cost: $10 for a name reservation (optional).

Step 3: Appoint a Board of Directors

California law requires a minimum of three directors for your nonprofit board. The board is responsible for overseeing the nonprofit’s activities, ensuring compliance with legal obligations, and making major decisions for the organization.

Recruiting Board Members: When selecting your board members, aim for individuals who bring diverse skills to the table, such as legal, financial, and fundraising expertise. Consider reaching out to individuals in your community who are passionate about your mission or professionals from industries related to your nonprofit’s work.

Here are a few tips for recruiting board members:

- Define clear expectations – Ensure that potential board members understand their roles and responsibilities.

- Look for diversity – A mix of skills, backgrounds, and experiences will strengthen your board’s decision-making.

- Use your network – Leverage your existing professional and personal networks, as well as social media, to find potential members.

- Public outreach – Announce your need for board members in community newsletters, local newspapers, or at events.

Step 4: Incorporate Your Nonprofit in California

To officially form your nonprofit in California, you need to file Articles of Incorporation with the California Secretary of State. This document outlines your nonprofit’s name, mission, and details about your board of directors.

Cost: $30 for filing the Articles of Incorporation.

How to File:

- File online via the Secretary of State’s website, or mail in the form.

- Be sure to use IRS-specific language in the Articles of Incorporation to ensure you can apply for federal tax-exempt status later.

Step 5: Apply for an Employer Identification Number (EIN)

The next step in forming your nonprofit is to obtain an Employer Identification Number (EIN) from the IRS. This number functions like a social security number for your nonprofit and is required for tax filings, opening a bank account, and hiring employees.

Cost: Free.

How to Apply:

- You can apply online through the IRS website or by submitting Form SS-4.

Step 6: Apply for 501(c)(3) Tax-Exempt Status (If Applicable)

Most nonprofits apply for federal tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This exempts the organization from federal income tax and allows donors to make tax-deductible contributions.

Cost: $275–$600 filing fee depending on the form you use (Form 1023-EZ vs. Form 1023).

How to Apply:

- Complete IRS Form 1023 (or the simplified Form 1023-EZ if your organization meets certain criteria).

- Submit your application online through the IRS’s e-Postcard system or by mail.

Step 7: Register with the California Attorney General’s Office

Once you’ve obtained 501(c)(3) status, you must register with the California Attorney General’s office as part of the process to comply with state fundraising laws. This is required for nonprofits that plan to solicit donations.

Cost: $25 for the initial registration.

Step 8: Apply for State Tax Exemption

In addition to federal tax-exempt status, you must apply for California state tax exemption with the Franchise Tax Board (FTB).

Cost: $0–$25, depending on your organization’s income.

Step 9: Set Up Financial Systems and Comply with State Reporting Requirements

Once your nonprofit is officially registered and exempt from taxes, you’ll need to set up robust financial systems to ensure compliance with both state and federal requirements. This includes preparing annual reports, maintaining financial records, and filing with the IRS and California authorities.

Step 10: Consider Fiscal Sponsorship

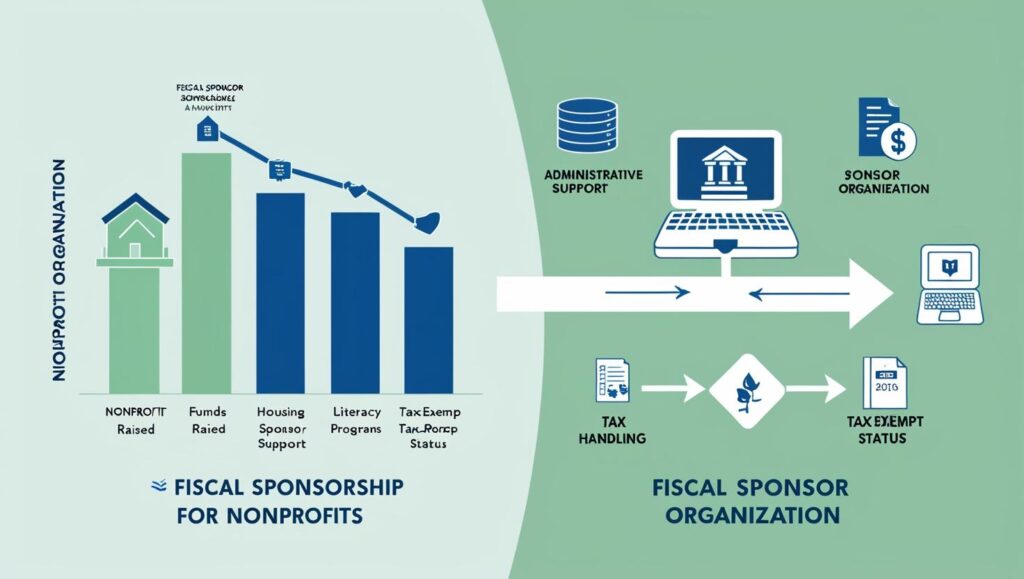

For those looking to start a nonprofit in Los Angeles but not yet ready to go through the full process of incorporation, fiscal sponsorship can be an attractive option. Fiscal sponsorship allows you to partner with an established nonprofit that provides administrative support, such as managing your funds and offering tax-exempt status.

Benefits of Fiscal Sponsorship:

- Quick setup without the complexity of forming your own nonprofit.

- Immediate access to funding opportunities that require tax-exempt status.

- Reduced administrative burden, as the fiscal sponsor handles much of the compliance work.

Types of Fiscal Sponsorship:

- Model A – The nonprofit directly supports your activities and funds, allowing you to operate under its tax-exempt status.

- Model C – The nonprofit and your organization sign an agreement to share both resources and liabilities.

Cost: Typically, a fiscal sponsor charges a 5–10% administrative fee on funds raised.

Costs of Starting a Nonprofit in Los Angeles:

- Incorporation Fee: $30

- IRS 501(c)(3) Filing Fee: $275–$600

- Attorney General Registration Fee: $25

- State Tax Exemption Fee: $0–$25

- Fiscal Sponsorship Fee (optional): 5–10% of funds raised

Contact Information & Resources:

For further assistance with starting your nonprofit in Los Angeles, or if you’re looking for expert help with fiscal sponsorship or tax exemption, reach out to Key Forecasts. We specialize in financial and tax compliance for nonprofits in Los Angeles and can help you navigate the complexities of nonprofit formation and operations.

- Key Forecasts

Phone: 213-444-2224

Website: https://keyforecasts.com

Email: info@keyforecasts.com - California Secretary of State

Website: https://www.sos.ca.gov/business-programs/business-entities

Phone: 916-657-5448 - IRS – Apply for EIN

Website: https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online - California Attorney General’s Office

Website: https://oag.ca.gov/charities

Phone: 800-952-5225

Conclusion:

Starting a nonprofit in Los Angeles requires careful planning and attention to detail, from deciding on your mission to ensuring tax compliance. Whether you go the traditional route or opt for fiscal sponsorship, it’s important to understand the steps involved and get the right guidance along the way. By following these steps and reaching out to professionals like Key Forecasts, you’ll be well on your way to launching a successful nonprofit that makes a meaningful impact on your community.

Small Business Accounting in California: The Complete Guide for Entrepreneurs

- The Ultimate Guide to Organizing Small Business Expenses in California

- The AB 5 Nightmare: How to Classify Workers in LA and Avoid Crippling Fines

- The Ultimate Financial Guide for LA Landscaping Businesses (C-27)

- Orange County Small Business Accounting vs. LA County: Key Differences in Taxes, Licenses, and Costs

- Los Angeles Non-Profit Accounting Guide: 2 CFR 200, Grants & 990

One response to “Your 2026 Blueprint: How to Launch a Nonprofit Organization in Los Angeles”

[…] Your 2026 Blueprint: How to Launch a Nonprofit Organization in Los AngelesStep-by-step guide for starting a nonprofit in Los Angeles, including information about fiscal sponsorship, costs, and various nonprofit options. […]