Cash is King, Not Profit

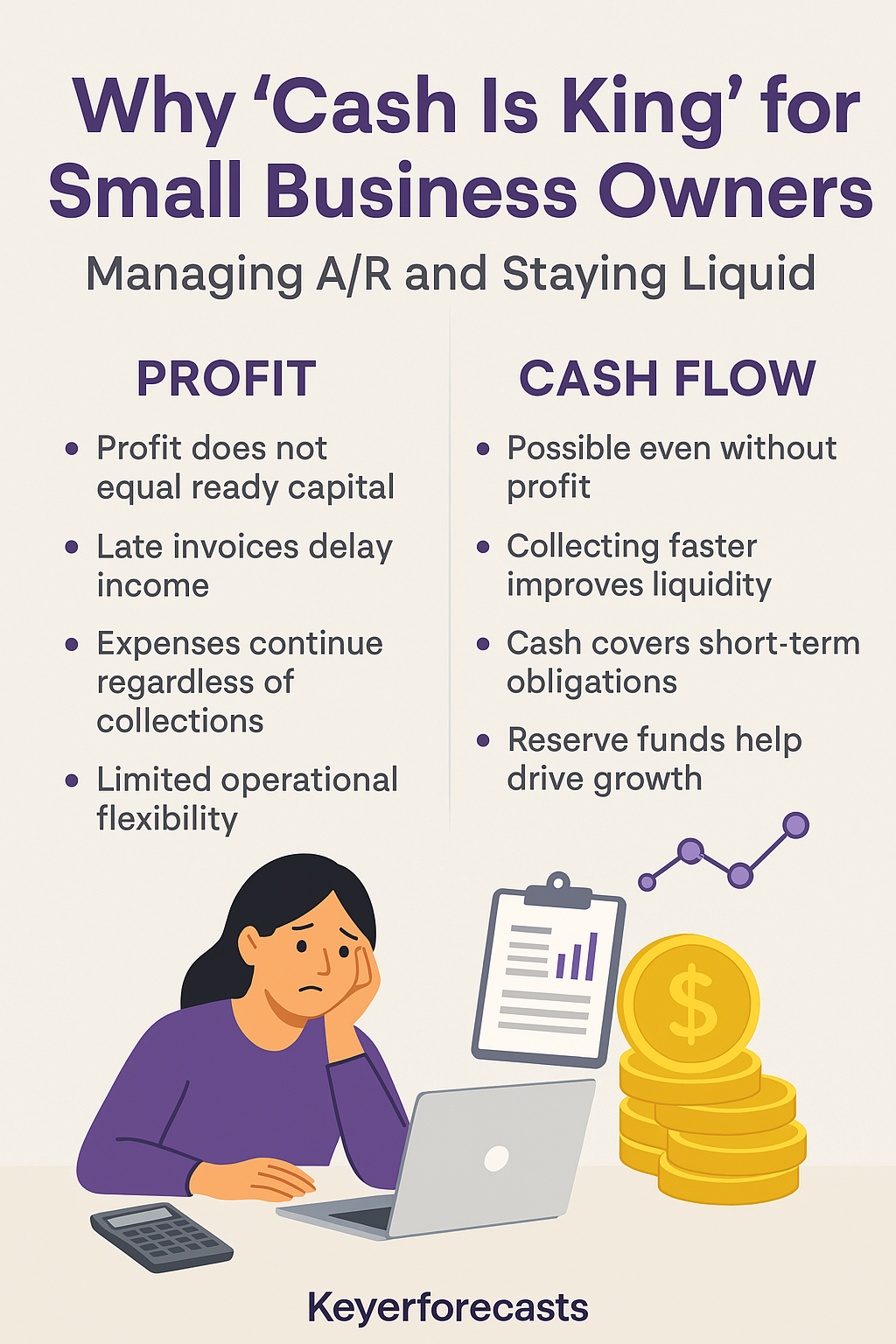

You can have a full schedule, a solid client list, and even a profitable P&L. But if your cash flow isn’t healthy, you’re playing with fire. This is one of the most common and deadly mistakes entrepreneurs make: confusing profit with available working capital.

Cash flow for small businesses is the true lifeblood. Without it, your business might look successful—but it won’t stay open.

Cash Flow vs. Profit in Small Business

Let’s be clear:

- Profit is what’s left on paper after revenue minus expenses.

- Cash flow is the actual movement of money in and out of your bank account.

You can be profitable and still run out of cash. This happens when:

- Customers delay payments

- Expenses outpace incoming funds

- You hold inventory for too long without sales

These scenarios are especially dangerous for small businesses that don’t have the credit lines or investor backing to survive a slow month.

Real-Life Small Business Cash Flow Examples

1. Event Planner in Los Angeles

A solopreneur runs a small event planning business. Clients often book 3-4 months in advance but pay the balance after the event. She shows a profit on paper but is constantly borrowing to pay vendors. If she doesn’t improve business cash reserves and collect partial payments earlier, she risks defaulting even in her busiest season.

2. Family-Owned Restaurant

A local restaurant offers catering services and receives large invoices from corporate customers. While the restaurant appears profitable due to those contracts, they wait 60 days for payment while needing to buy food and pay staff weekly. Without cash reserves, one missed payment nearly shut them down during the holidays.

3. Auto Repair Shop in Long Beach

An auto shop repairs a fleet of vehicles for a delivery company. The business logs a healthy monthly profit. But with parts suppliers demanding cash on delivery and customers paying on net-30 terms, they’re forced to juggle vendor payments, payroll, and utilities without enough working capital. The owner starts dipping into personal savings to stay afloat.

These are common—and avoidable—cash flow crises.

The Danger of Ignoring A/R

If you’re not actively managing your accounts receivable, you’re lending out your services and hoping to be paid eventually. That’s not a business model—it’s a gamble.

Manage accounts receivable effectively by:

- Setting up clear invoicing systems

- Following up consistently on overdue invoices

- Sending reminders before due dates

- Charging late fees or offering early payment discounts

Letting invoices sit unpaid for 45–60 days can leave you scrambling for cash even if business is booming.

Why Cash Is King in Business

You’ve heard the phrase “Cash is King.” But why?

Because profit doesn’t pay rent. Cash does.

You can’t write checks against accounts receivable or future earnings. You need cash in your bank account to cover:

- Payroll

- Rent and utilities

- Inventory or equipment purchases

- Taxes and loan payments

Cash flow for small businesses isn’t a technical term—it’s a survival mechanism.

Timing Is Everything: Credit vs. Cash

You might sell $10,000 worth of products this month, but if payment isn’t due for 30–60 days, you could be left scrambling to cover your expenses today.

Credit terms can delay access to your own money. And in small business, timing is everything.

Small business invoice management means controlling the speed at which cash comes in. The slower the cash, the more fragile your business becomes.

Small Business Financial Management Tips

Here are small business financial management tips that can help you avoid a cash flow crunch:

- Review cash flow weekly

Use a dashboard, QuickBooks, Wave, or a simple spreadsheet. - Forecast ahead

Look 30/60/90 days into the future and spot cash shortages before they happen. - Automate invoicing

Send invoices immediately after delivery of goods or services. Offer easy online payment options. - Have a collections strategy

Follow up at 7, 14, and 30 days. Don’t wait until it’s critical. - Separate savings for taxes and emergencies

Don’t let tax bills or emergencies catch you off guard. Transfer a percentage of each payment to a reserve account. - Set payment expectations

Use net-15 or net-30 terms. Avoid vague or overly generous credit policies. - Incentivize early payment

Offer a 1–2% discount for payment within 10 days to speed up cash flow. - Avoid relying too heavily on credit

Credit should supplement cash—not replace it. - Limit inventory bloat

Holding excess inventory ties up cash that could be used elsewhere. - Build and protect your cash cushion

Aim for 1–2 months of expenses in cash to protect against seasonality or slow months.

What Success Looks Like

When you prioritize cash flow over profit, your business becomes stronger. You:

- Pay vendors early and gain leverage

- Sleep better knowing you can meet obligations

- Take advantage of unexpected opportunities

- Avoid loans and late fees

- Grow with confidence, not fear

Financial mistakes small business owners make often stem from chasing sales and profits without looking at the bank balance. Don’t let that be you.

Conclusion:

Cash isn’t just king—it’s your lifeline. Profit means little if your bank account is empty. Don’t fall into the trap of chasing sales and ignoring collections. Stay liquid. Stay smart. And most importantly—stay in business.