Category: Nonprofit

-

Financial Guide for Los Angeles Non-Profits: Grant Management, Compliance & Reporting Operating a non-profit in Los Angeles is a unique challenge. You’re driven by a mission, working to solve some of the community’s toughest problems. But that passion is often met with the overwhelming burden of complex financial administration. Unlike a standard for-profit business, non-profits…

-

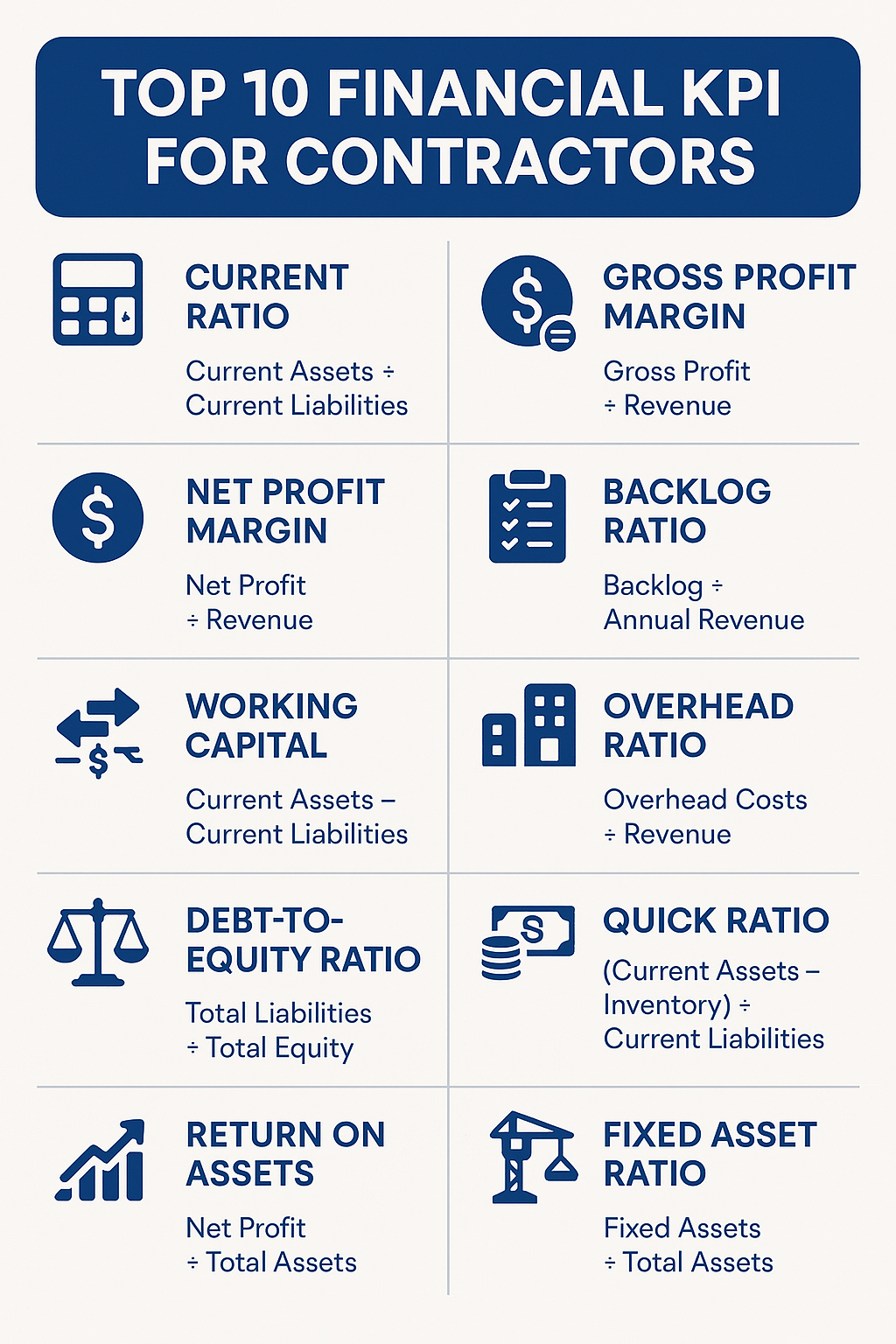

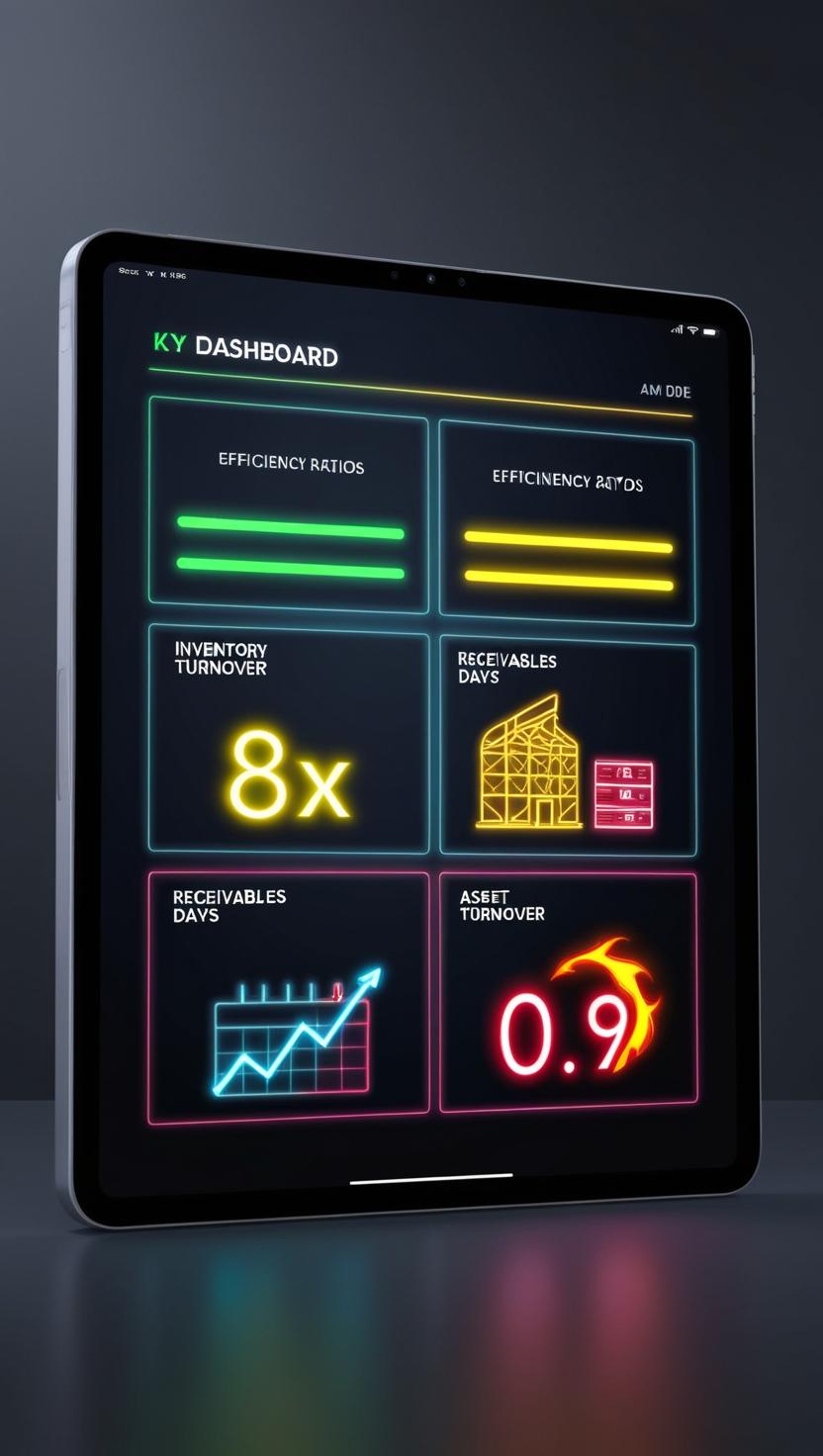

Financial KPIs Explained: Make Smarter, Safer, and More Profitable Decisions Whether you’re buying new equipment, expanding your service area, or just trying to improve your margins, the smartest business owners track more than just revenue. This guide covers 18 of the most powerful financial KPIs and investment metrics—from simple liquidity ratios to strategic ROI tools…

-

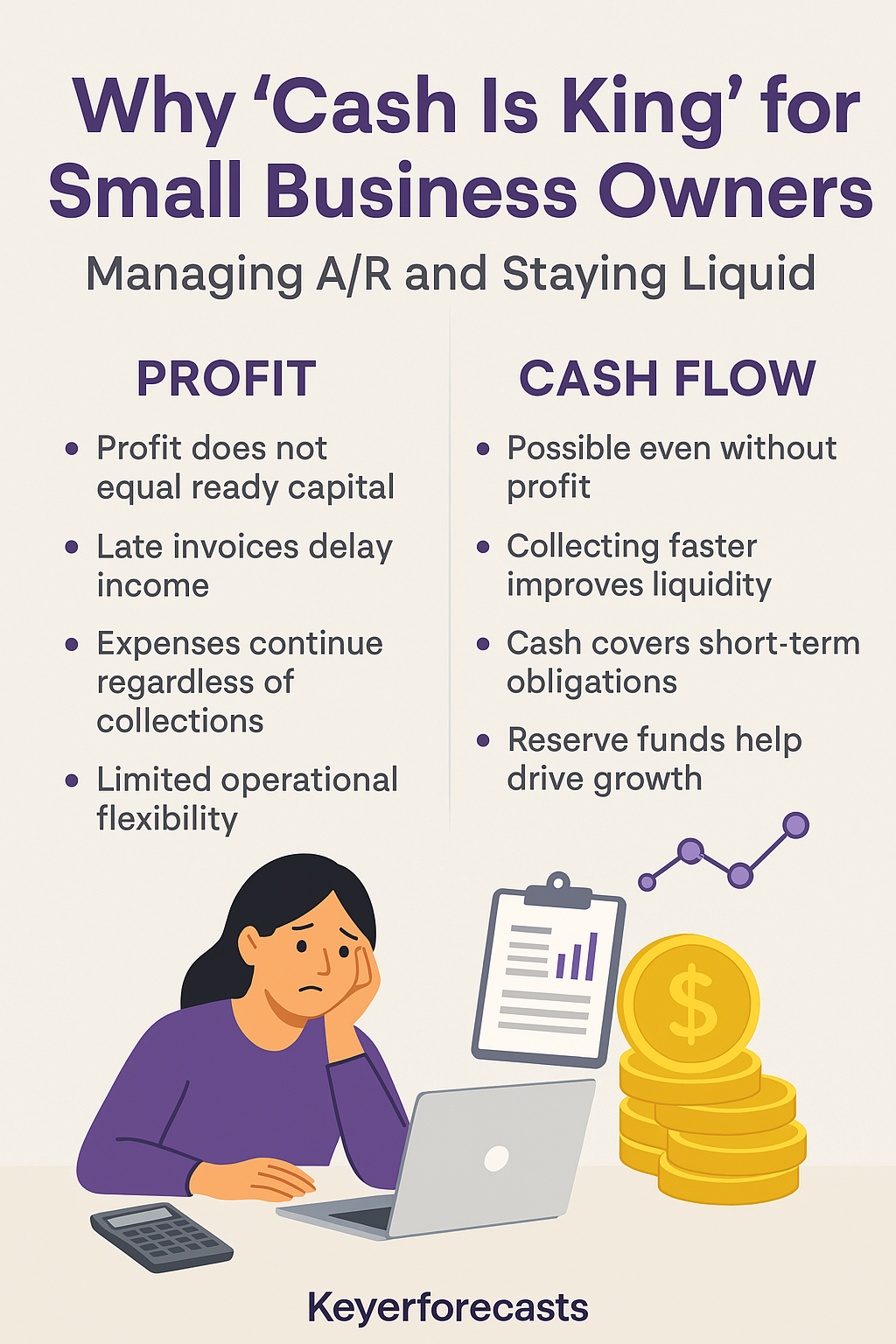

Cash is King, Not Profit You can have a full schedule, a solid client list, and even a profitable P&L. But if your cash flow isn’t healthy, you’re playing with fire. This is one of the most common and deadly mistakes entrepreneurs make: confusing profit with available working capital. Cash flow for small businesses is…

-

How to Start a Nonprofit in Los Angeles: A Step-by-Step Guide Step-by-step guide for starting a nonprofit in Los Angeles, including information about fiscal sponsorship, costs, and various nonprofit options. Starting a nonprofit in Los Angeles is a rewarding venture, whether you aim to serve the community, support a cause, or provide services. But the…

-

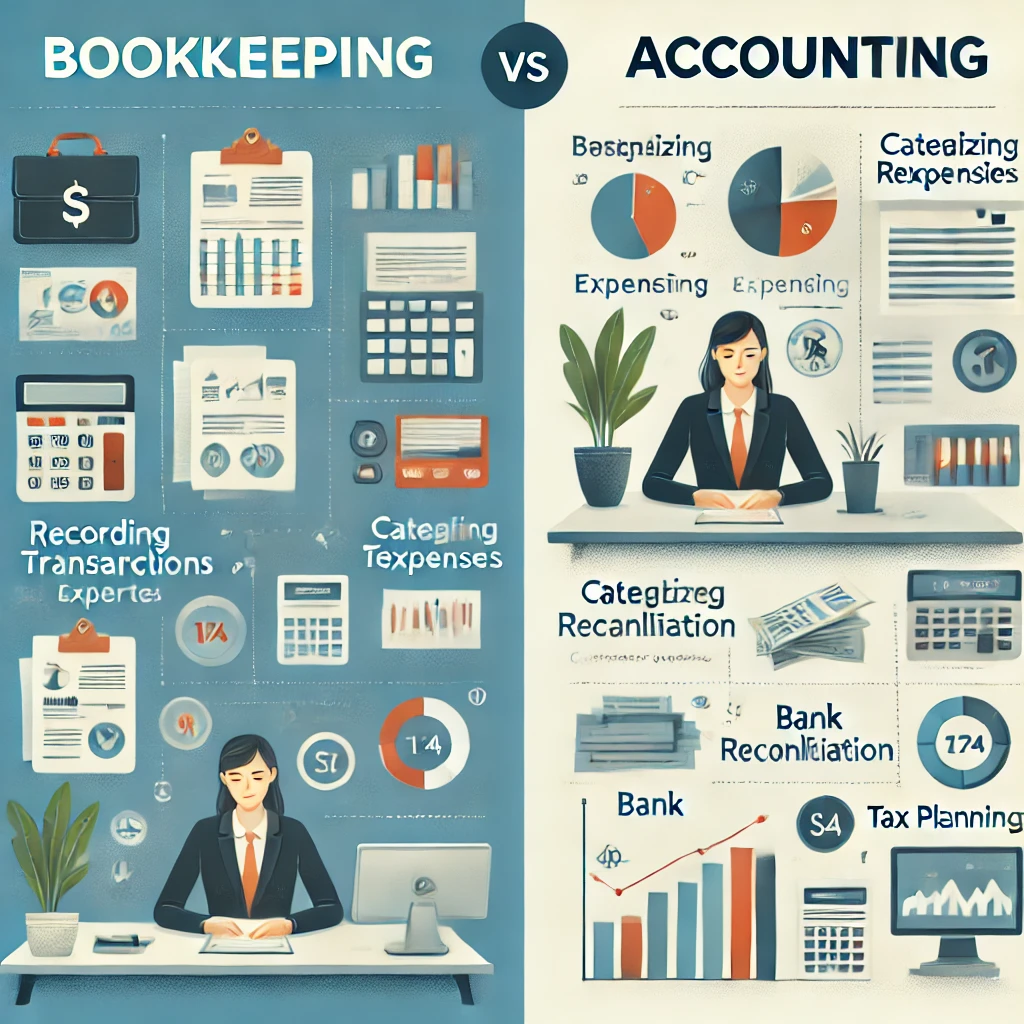

Step-by-Step: Understanding the Key Differences Between Bookkeeping and Accounting The Financial Compass: Navigating Bookkeeping and Accounting in Los Angeles Bookkeeping vs. Accounting: Key Differences Every LA Small Business Owner Needs to Know As a small business owner in Los Angeles, understanding the difference between bookkeeping and accounting can save you time, reduce stress, and ultimately…

-

Note: Grant opportunities and deadlines may change. Always verify current information directly with the grantor. Private Foundation Grants 1. The California Endowment 2. Weingart Foundation 3. The Ralph M. Parsons Foundation Community Foundation Grants 4. California Community Foundation 5. San Diego Foundation Corporate Grants 6. Wells Fargo Foundation 7. Edison International 8. Bank of America…

-

Grant Writing Strategies Writing a strong grant proposal is essential for nonprofit organizations seeking funding to support their programs and initiatives. A well-structured and compelling grant application not only increases the chances of approval but also demonstrates your organization’s credibility, financial accountability, and ability to create meaningful impact. This guide will take you through the…

-

Introduction Having strong business credit is essential for securing loans, negotiating better vendor terms, and establishing financial credibility. However, many small business owners either rely on personal credit or don’t know where to start when it comes to building business credit. If you’re looking to grow your business, establishing and improving business credit should be…

-

Introduction Securing funding is a significant challenge for small business owners in Orange County. Whether you’re launching a startup, expanding operations, or recovering from financial setbacks, accessing the right funding is crucial. Orange County offers a range of grants, loans, and alternative financing options tailored to small businesses. In this guide, we’ll explore the best…

-

Nonprofits that receive federal grant funding must comply with Uniform Guidance (2 CFR 200) to maintain funding, ensure transparency, and avoid penalties. These federal regulations, established by the Office of Management and Budget (OMB), set the standard for financial management, procurement, allowable costs, and audits. Understanding these rules is essential for nonprofit leaders, grant managers,…