Category: Small Business

-

📋 The 3 Easiest Ways to Organize Small Business Expenses in California If you’re a small business owner in California, keeping your expenses perfectly organized isn’t just about taxes—it’s about staying compliant, maximizing deductions, and knowing your true profitability. Chaos is costly. As a financial controller with 18+ years of experience, I know not everyone…

-

In California, a single sentence can cost a small business $50,000 or more: “Oh, don’t worry, they’re just a 1099 contractor.” This common phrase—and the misunderstanding behind it—is the single biggest compliance “nightmare” facing Los Angeles business owners. Assembly Bill 5 (AB 5) fundamentally changed the rules. The old “if-they-say-they’re-a-contractor-it’s-fine”-test is long gone. Now, the…

-

Choosing the right bookkeeping service is a crucial step for Los Angeles small business owners seeking to maintain accurate financial records, stay compliant with tax laws, and gain actionable insights into their business performance. Whether you’re a startup or an established business, finding a bookkeeping provider experienced in the unique demands of the LA market…

-

Running a small business in California comes with unique financial challenges and regulatory requirements. This comprehensive guide walks you through everything you need to know—from foundational bookkeeping to complex tax obligations—to stay compliant, maximize deductions, and build a financially healthy business. Why Small Business Accounting Matters in California Accurate accounting is the backbone of any…

-

You’ve done everything right — you’re a safe driver, your car’s getting older, and you haven’t filed any claims. So why does your car insurance premium still go up every year? Shouldn’t your insurance cost less as your vehicle depreciates? If you’ve ever felt blindsided by a premium increase, you’re not alone — and you’re…

-

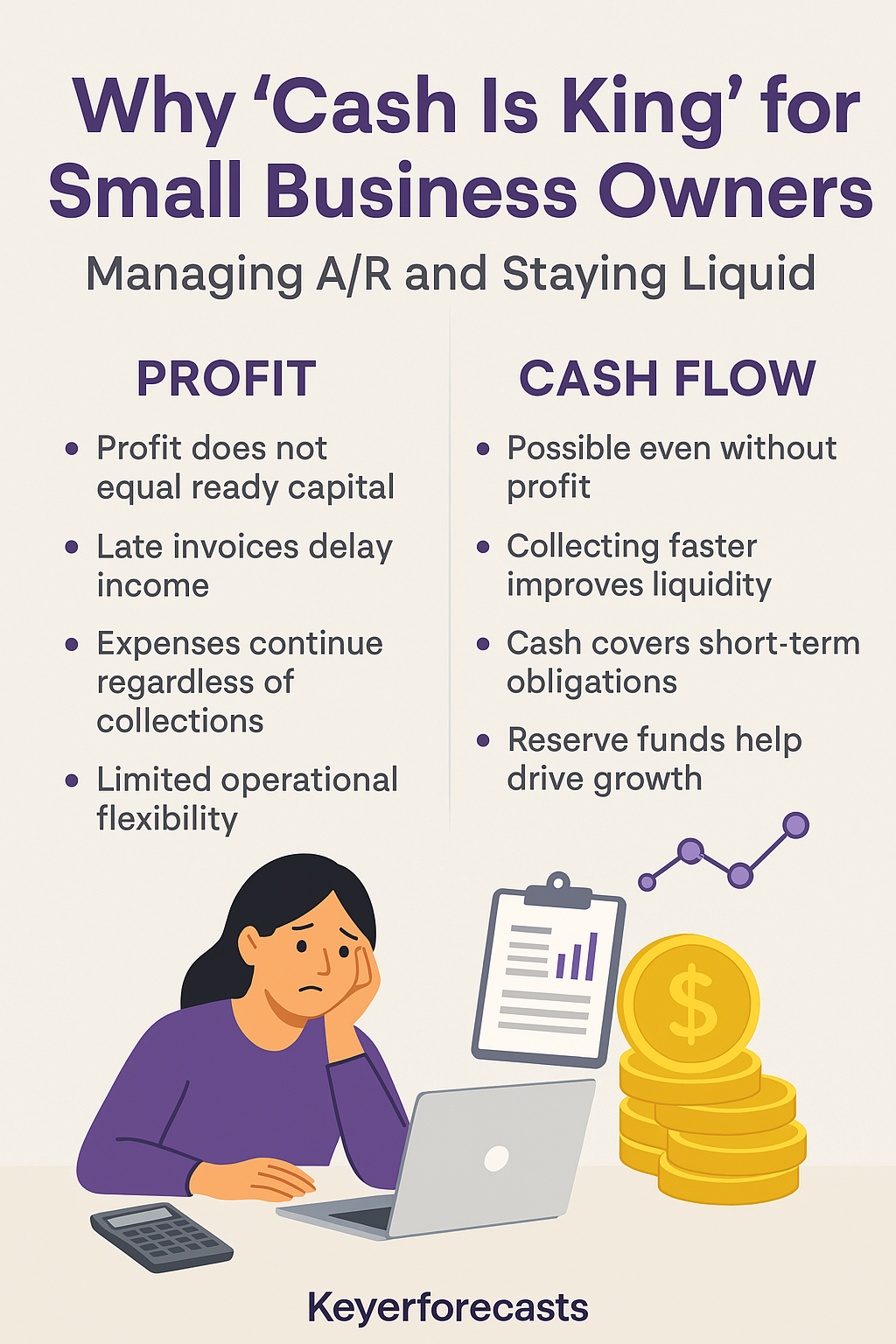

Actionable insights, forecasting tips, and financial clarity for small businesses and nonprofits. Brought to you by Key Forecasts, where small business meets CFO-level expertise. Financial mistakes small business owners make often stem from chasing sales and profits without looking at the bank balance. Don’t let that be you. Cash isn’t just king—it’s your lifeline. Profit…

-

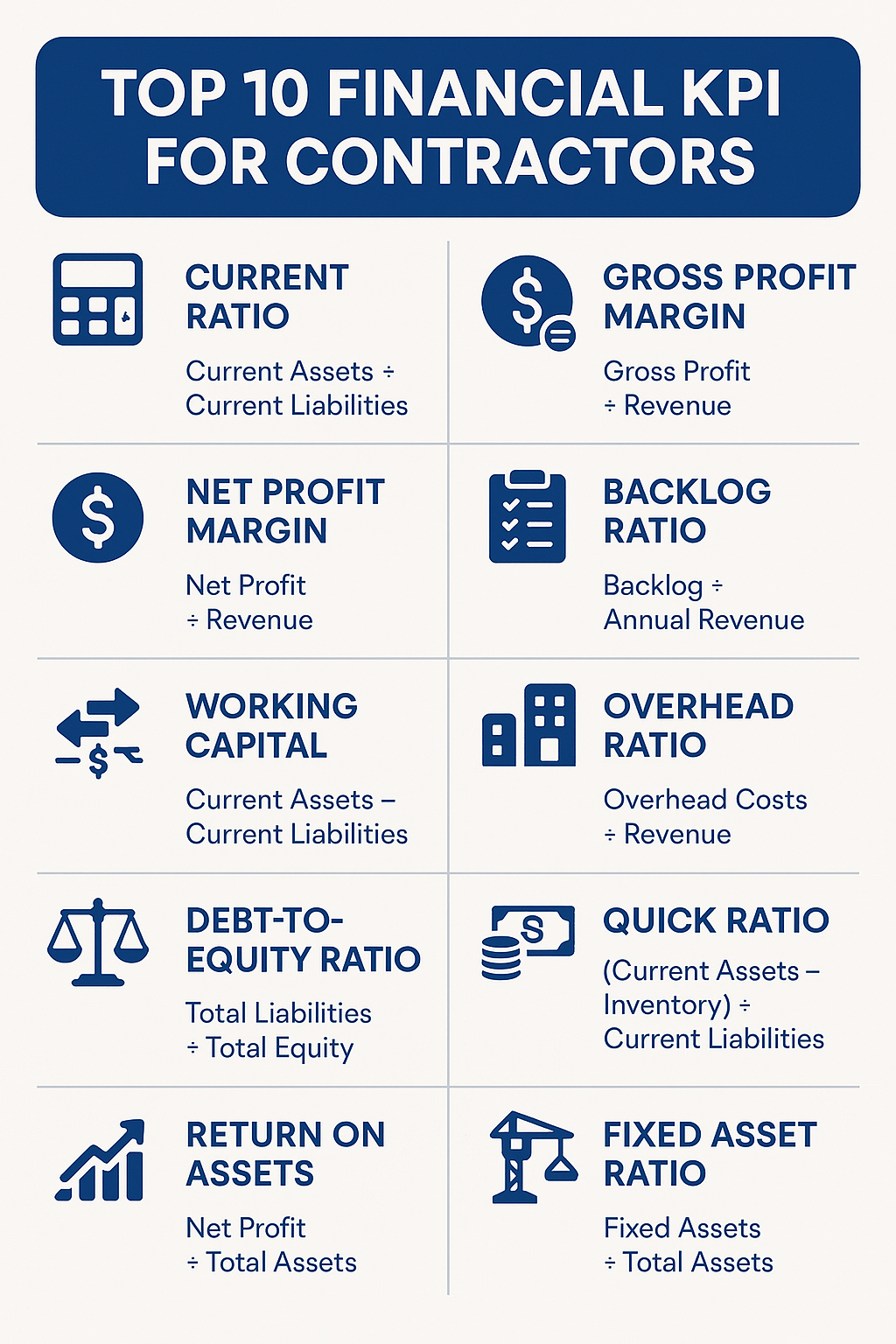

Financial KPIs Explained: Make Smarter, Safer, and More Profitable Decisions Whether you’re buying new equipment, expanding your service area, or just trying to improve your margins, the smartest business owners track more than just revenue. This guide covers 18 of the most powerful financial KPIs and investment metrics—from simple liquidity ratios to strategic ROI tools…

-

Cash is King, Not Profit You can have a full schedule, a solid client list, and even a profitable P&L. But if your cash flow isn’t healthy, you’re playing with fire. This is one of the most common and deadly mistakes entrepreneurs make: confusing profit with available working capital. Cash flow for small businesses is…

-

Influencer Income: How to Track & Manage Your Finances As an influencer, managing your finances is just as important as growing your brand. With income coming from multiple sources, including brand deals, sponsorships, ad revenue, and affiliate marketing, staying on top of your earnings and expenses is essential. This step-by-step guide will help you effectively…

-

Step-by-Step: Understanding the Key Differences Between Bookkeeping and Accounting The Financial Compass: Navigating Bookkeeping and Accounting in Los Angeles Bookkeeping vs. Accounting: Key Differences Every LA Small Business Owner Needs to Know As a small business owner in Los Angeles, understanding the difference between bookkeeping and accounting can save you time, reduce stress, and ultimately…