Financial KPIs Explained: Make Smarter, Safer, and More Profitable Decisions

Whether you’re buying new equipment, expanding your service area, or just trying to improve your margins, the smartest business owners track more than just revenue. This guide covers 18 of the most powerful financial KPIs and investment metrics—from simple liquidity ratios to strategic ROI tools like IRR and CAPM.

Each one includes:

- What it means

- The formula

- Where to get the data

- A small business example

- What the result tells you

- What to do about it

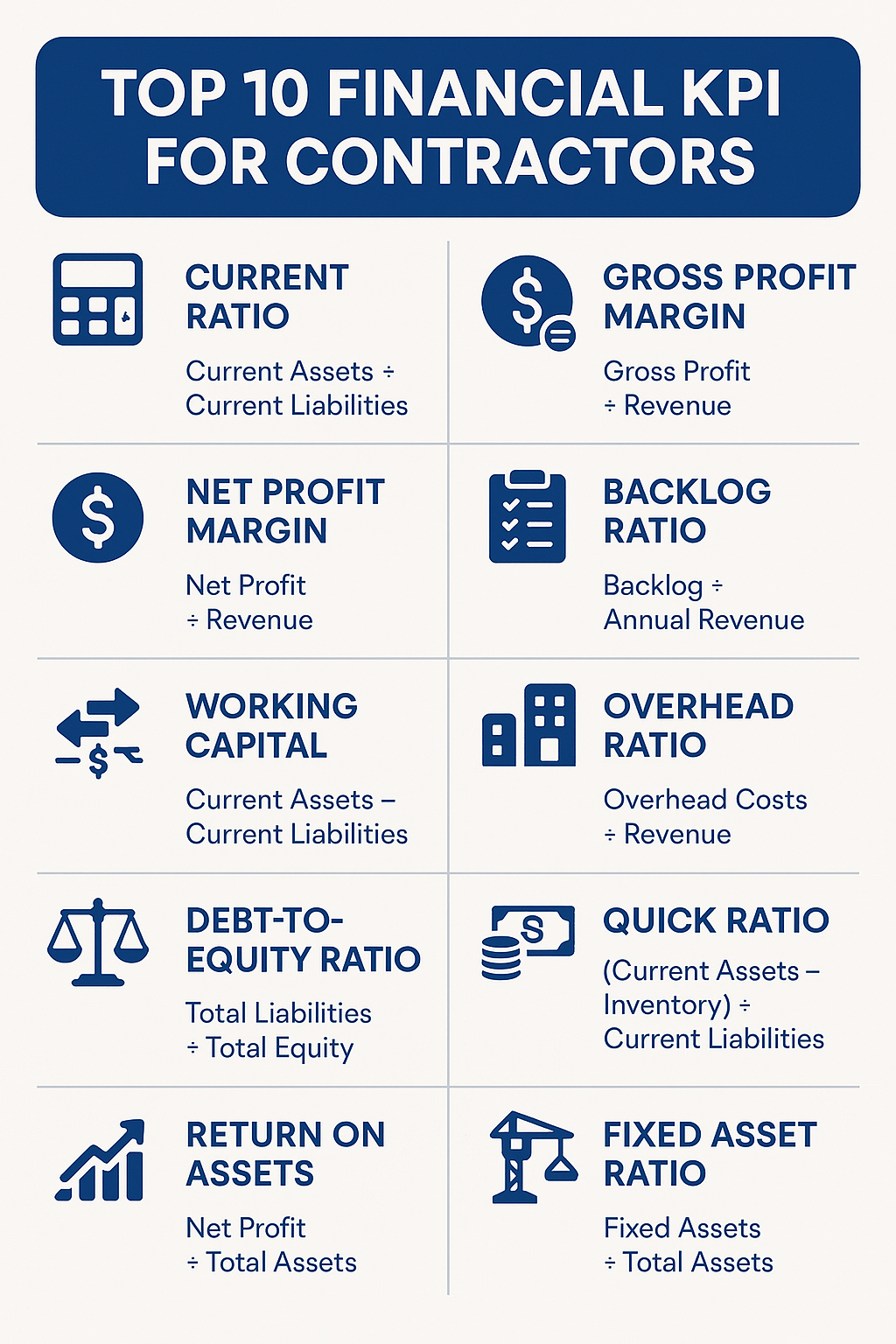

SECTION 1: Core Financial KPIs (Tracked Monthly or Quarterly)

1. Return on Assets (ROA)

Formula: Net Income / Total Assets

Example: $50,000 / $400,000 = 12.5%

Why it matters: This shows how efficiently you use assets. Under 5%? You may have underperforming equipment or property.

2. Return on Equity (ROE)

Formula: Net Income / Shareholder Equity

Example: $30,000 / $200,000 = 15%

Why it matters: Indicates your business is yielding strong returns on your own capital.

3. Gross Profit Margin

Formula: (Revenue – COGS) / Revenue

Example: (150k – 90k) / 150k = 40%

Why it matters: A strong gross margin covers overhead and drives profitability.

4. Operating Profit Margin

Formula: Operating Income / Revenue

Example: 60k / 300k = 20%

Why it matters: Tells you how profitable your business is before taxes and interest.

5. Net Profit Margin

Formula: Net Profit / Revenue

Example: 18k / 180k = 10%

Why it matters: The ultimate profitability measure. Under 5%? Check pricing, COGS, or overhead.

6. Quick Ratio

Formula: (Cash + AR) / Current Liabilities

Example: (15k + 10k) / 12k = 2.08

Why it matters: Shows if you can pay short-term obligations without inventory.

7. Current Ratio

Formula: Current Assets / Current Liabilities

Example: 7k / 3.5k = 2.0

Why it matters: Under 1.0 = cash crunch risk. Over 3.0 = possible inefficiency.

8. Inventory Turnover

Formula: COGS / Average Inventory

Example: 200k / 40k = 5x/year

Why it matters: Too low? You’re holding slow-moving or excess stock.

9. Accounts Receivable Turnover

Formula: Net Credit Sales / Average AR

Example: 150k / 25k = 6x/year

Why it matters: Low turnover = slow payments and stressed cash flow.

10. Debt-to-Equity Ratio

Formula: Total Liabilities / Shareholder Equity

Example: 100k / 80k = 1.25

Why it matters: Over 2.0 = high leverage risk. Under 1.0 = more conservative.

11. Interest Coverage Ratio

Formula: EBIT / Interest Expense

Example: 45k / 12k = 3.75

Why it matters: Under 2.0 = dangerous. Over 3 = strong debt-handling ability.

12. Customer Acquisition Cost (CAC)

Formula: Sales & Marketing Costs / New Customers

Example: $5,000 / 25 = $200 per customer

Why it matters: CAC must be less than 1/3 of customer LTV.

13. Customer Lifetime Value (LTV)

Formula: Avg Revenue × Gross Margin × Retention Period

Example: $75 × 60% × 12 = $540

Why it matters: If LTV isn’t at least 3× CAC, your acquisition isn’t sustainable.

14. Burn Rate

Formula: Operating Expenses – Revenue (monthly)

Example: $40k – $25k = $15k/month burn

Why it matters: Know your runway. With $90k cash, you have 6 months.

15. Break-Even Point

Formula: Fixed Costs / (Price – Variable Cost per Unit)

Example: $10,000 / ($20 – $8) = 833 units/month

Why it matters: If you can’t hit break-even sales consistently, you’re losing money.

SECTION 2: Strategic Investment Metrics (Use for Big Decisions)

16. Internal Rate of Return (IRR)

Formula: Use Excel’s =IRR() function with projected cash flows.

Example:

$10,000 ad campaign generates $800/month for 18 months.

IRR = ~42%

Why it matters: If IRR > your cost of capital (say 12%), the project adds value.

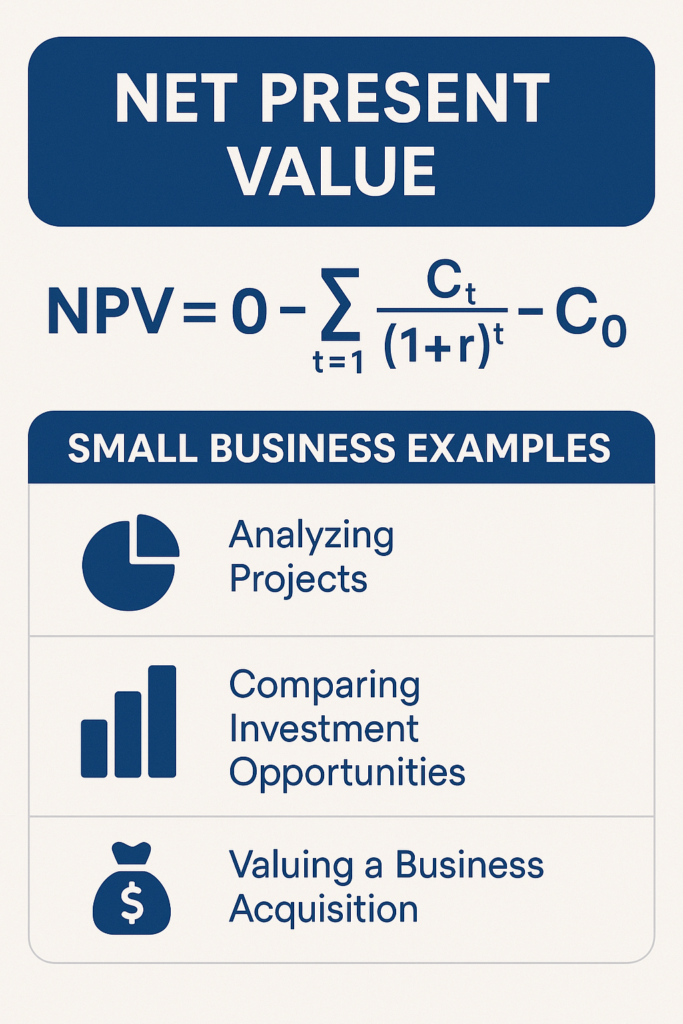

17. Net Present Value (NPV)

Formula:

NPV = ∑ (Cash flow / (1 + discount rate)^t) – Initial Investment

Example: $1,000/month return for 12 months, 10% rate, $8,000 investment

NPV ≈ $2,345

Why it matters: Positive NPV = profitable project. Negative = avoid or re-evaluate.

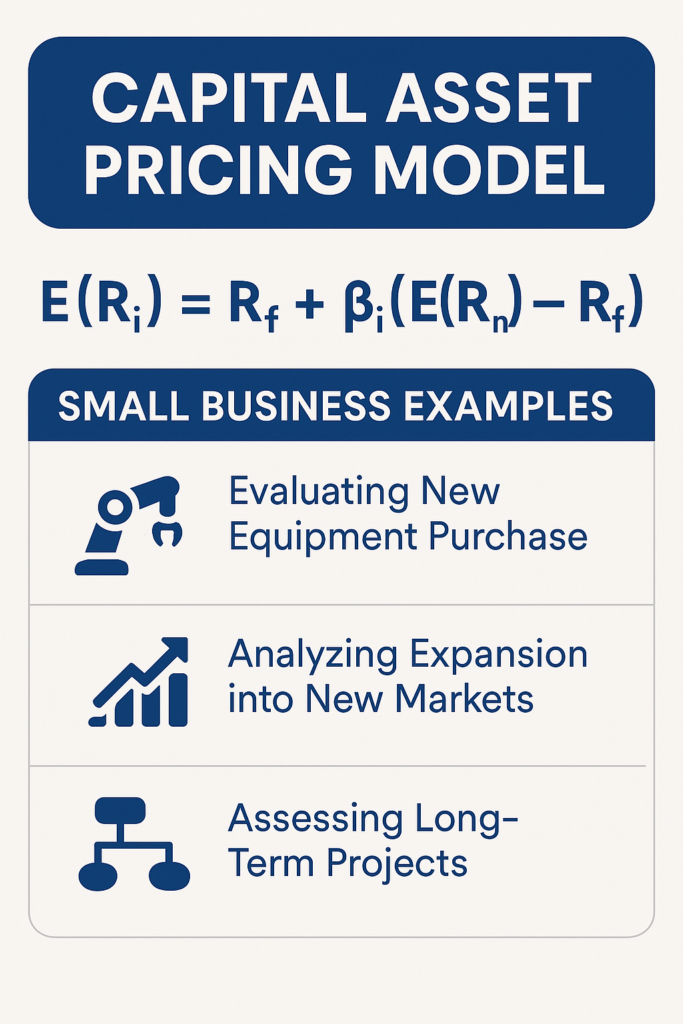

18. Capital Asset Pricing Model (CAPM)

Formula:

Expected Return = Risk-Free Rate + Beta × (Market Return – Risk-Free Rate)

Inputs:

- Risk-Free Rate: 10-Year Treasury yield, e.g., 4% (from MarketWatch or Treasury.gov)

- Market Return: Historical S&P 500 average = ~10%

- Beta: From comparable public companies on Yahoo Finance (e.g., 1.5 for construction firms)

Example – Equipment Investment:

4% + 1.5 × (10% – 4%) = 13% expected return

Why it matters: Only pursue risky investments if expected return exceeds the CAPM threshold. Otherwise, the risk isn’t justified.

Final Thoughts: Know Your Numbers, Make Better Moves

These KPIs and investment metrics aren’t just for big corporations—they’re essential tools for every small business. They help you:

- Set smarter pricing

- Avoid cash flow surprises

- Justify or reject investments

- Improve profitability

- Grow sustainably

Want Help Applying This to Your Business?

At Key Forecasts, we turn your numbers into insights and action plans. We’ll build your dashboard, analyze your ratios, and show you how to improve your business financially.

Book your free consultation today:

https://keyforecasts.com